All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance plan right approximately line of it becoming a Customized Endowment Contract (MEC). When you use a PUAR, you quickly increase your money value (and your survivor benefit), therefore increasing the power of your "financial institution". Even more, the more money worth you have, the better your interest and reward repayments from your insurance coverage business will be.

With the increase of TikTok as an information-sharing system, financial suggestions and strategies have found a novel method of spreading. One such technique that has actually been making the rounds is the infinite banking concept, or IBC for brief, gathering endorsements from celebs like rapper Waka Flocka Flame. While the approach is presently prominent, its roots map back to the 1980s when financial expert Nelson Nash introduced it to the globe.

Is there a way to automate Infinite Banking transactions?

Within these plans, the cash money worth expands based upon a rate established by the insurance company (Infinite Banking for retirement). Once a significant cash money value builds up, policyholders can get a cash value finance. These fundings differ from conventional ones, with life insurance functioning as security, meaning one can shed their protection if loaning exceedingly without ample cash money value to support the insurance coverage costs

And while the appeal of these policies appears, there are inherent restrictions and threats, necessitating diligent money value monitoring. The approach's authenticity isn't black and white. For high-net-worth individuals or business owners, especially those making use of techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound development could be appealing.

The appeal of unlimited financial doesn't negate its difficulties: Price: The fundamental need, a permanent life insurance plan, is pricier than its term equivalents. Qualification: Not everybody receives entire life insurance policy due to rigorous underwriting processes that can omit those with particular health or way of living conditions. Complexity and danger: The intricate nature of IBC, combined with its risks, might discourage several, especially when simpler and less high-risk alternatives are available.

What are the benefits of using Infinite Banking In Life Insurance for personal financing?

Allocating around 10% of your regular monthly earnings to the policy is just not possible for a lot of individuals. Component of what you read below is simply a reiteration of what has actually already been said above.

Before you get yourself into a scenario you're not prepared for, understand the following first: Although the idea is frequently sold as such, you're not actually taking a finance from yourself. If that were the instance, you wouldn't need to repay it. Instead, you're borrowing from the insurance provider and need to settle it with rate of interest.

Some social media blog posts recommend making use of money worth from whole life insurance to pay down debt card debt. When you pay back the lending, a section of that rate of interest goes to the insurance coverage firm.

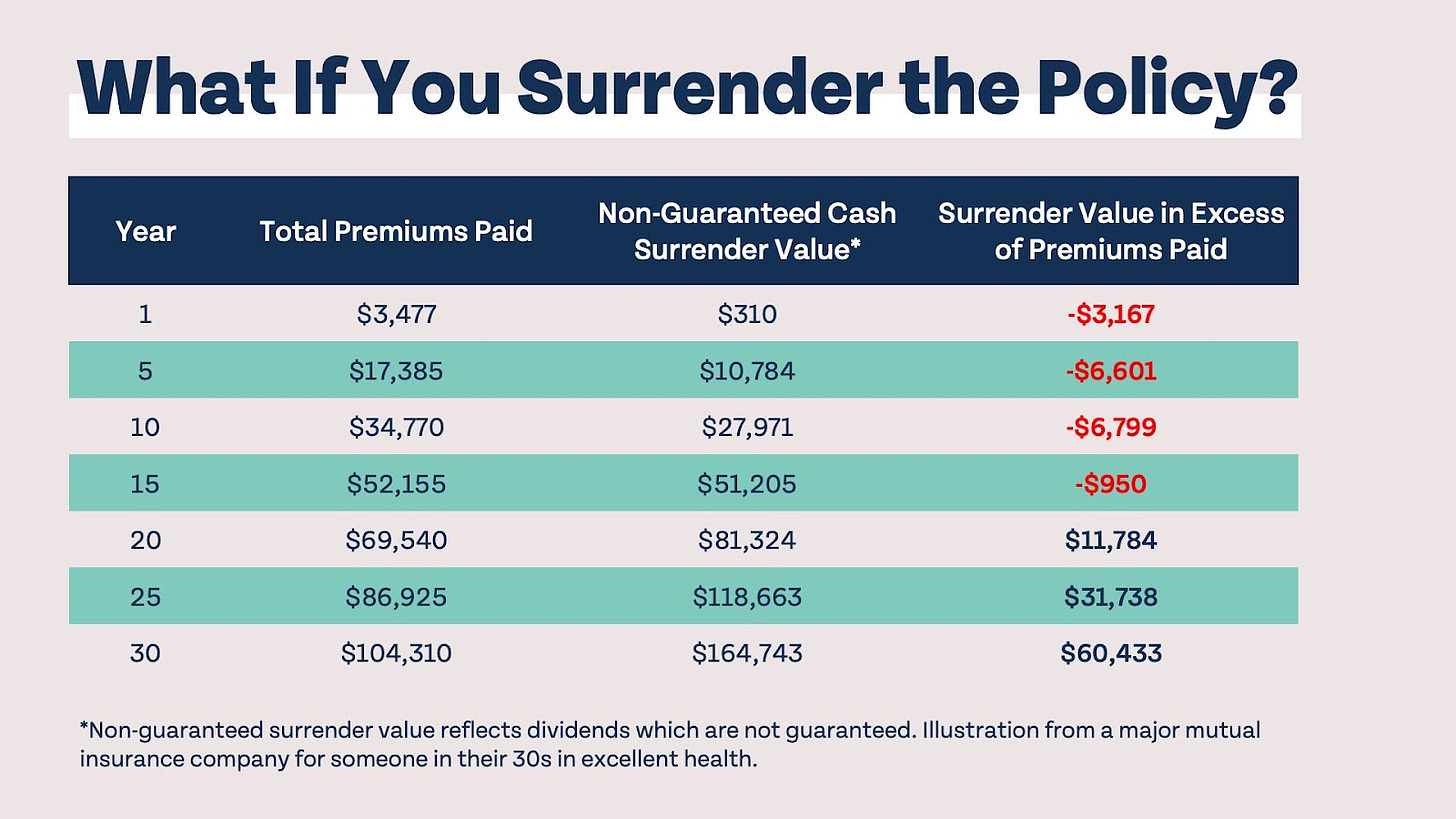

For the first a number of years, you'll be settling the commission. This makes it incredibly hard for your policy to collect worth during this moment. Entire life insurance coverage prices 5 to 15 times extra than term insurance coverage. The majority of people just can not manage it. Unless you can manage to pay a couple of to a number of hundred dollars for the next decade or even more, IBC won't function for you.

What is the long-term impact of Life Insurance Loans on my financial plan?

If you call for life insurance, below are some useful suggestions to take into consideration: Consider term life insurance. Make certain to shop around for the finest price.

Visualize never needing to bother with small business loan or high interest prices again. What if you could obtain cash on your terms and build riches concurrently? That's the power of boundless financial life insurance policy. By leveraging the cash money value of whole life insurance policy IUL plans, you can grow your wealth and borrow cash without counting on typical financial institutions.

There's no collection financing term, and you have the freedom to pick the settlement routine, which can be as leisurely as settling the car loan at the time of fatality. Policy loan strategy. This versatility encompasses the servicing of the car loans, where you can opt for interest-only repayments, maintaining the loan equilibrium flat and manageable

Holding cash in an IUL dealt with account being attributed interest can typically be far better than holding the cash on deposit at a bank.: You've always desired for opening your very own bakeshop. You can borrow from your IUL plan to cover the preliminary costs of renting a space, acquiring equipment, and hiring personnel.

Can Private Banking Strategies protect me in an economic downturn?

Individual lendings can be acquired from typical financial institutions and credit score unions. Borrowing cash on a credit scores card is typically very costly with annual percentage rates of passion (APR) commonly getting to 20% to 30% or more a year.

Latest Posts

Cash Flow Whole Life Insurance

How To Set Up Infinite Banking

Infinite Banking Concept Canada