All Categories

Featured

Table of Contents

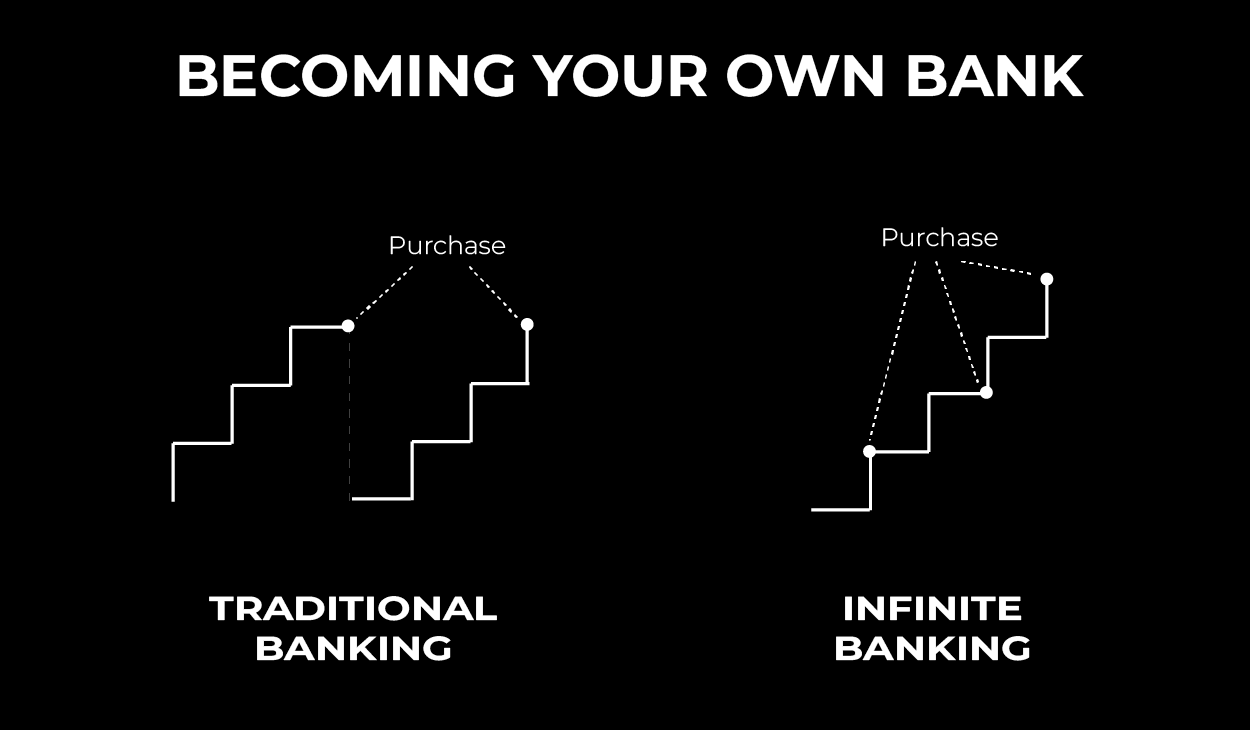

The approach has its own advantages, but it additionally has problems with high costs, complexity, and a lot more, leading to it being considered a rip-off by some. Infinite financial is not the most effective policy if you need just the financial investment element. The limitless financial concept revolves around using whole life insurance policy policies as an economic device.

A PUAR permits you to "overfund" your insurance coverage right up to line of it ending up being a Changed Endowment Contract (MEC). When you utilize a PUAR, you rapidly raise your cash money value (and your death advantage), thus raising the power of your "financial institution". Additionally, the even more cash money worth you have, the greater your interest and dividend settlements from your insurer will certainly be.

With the increase of TikTok as an information-sharing system, economic advice and techniques have located an unique method of spreading. One such approach that has been making the rounds is the infinite banking concept, or IBC for short, garnering recommendations from celebrities like rap artist Waka Flocka Flame - Infinite Banking account setup. Nonetheless, while the approach is presently popular, its roots map back to the 1980s when economic expert Nelson Nash introduced it to the world.

What makes Bank On Yourself different from other wealth strategies?

Within these plans, the cash money value grows based upon a price set by the insurer. Once a considerable money worth gathers, insurance holders can obtain a cash worth car loan. These loans differ from conventional ones, with life insurance policy working as collateral, suggesting one can shed their protection if borrowing exceedingly without ample money value to sustain the insurance coverage costs.

And while the allure of these policies appears, there are innate restrictions and threats, demanding diligent money worth monitoring. The approach's legitimacy isn't black and white. For high-net-worth people or company owner, especially those making use of methods like company-owned life insurance (COLI), the advantages of tax breaks and substance development might be appealing.

The allure of limitless banking does not negate its difficulties: Expense: The foundational need, a permanent life insurance plan, is more expensive than its term equivalents. Eligibility: Not everyone gets approved for entire life insurance policy because of rigorous underwriting procedures that can exclude those with certain wellness or way of living conditions. Complexity and danger: The detailed nature of IBC, coupled with its threats, might deter numerous, especially when less complex and much less high-risk options are readily available.

What are the tax advantages of Generational Wealth With Infinite Banking?

Assigning around 10% of your monthly earnings to the plan is simply not viable for most people. Component of what you read below is just a reiteration of what has actually already been stated above.

Before you get yourself into a circumstance you're not prepared for, recognize the adhering to initially: Although the concept is typically sold as such, you're not in fact taking a finance from on your own. If that held true, you would not need to repay it. Instead, you're obtaining from the insurance provider and need to repay it with interest.

Some social media blog posts advise using cash money value from whole life insurance to pay down credit scores card financial debt. When you pay back the financing, a part of that passion goes to the insurance policy business.

Is Financial Independence Through Infinite Banking a good strategy for generational wealth?

For the very first numerous years, you'll be paying off the commission. This makes it very challenging for your plan to build up worth throughout this time. Unless you can afford to pay a couple of to numerous hundred bucks for the next years or more, IBC will not function for you.

Not everybody must rely exclusively on themselves for financial safety and security. Self-banking system. If you require life insurance policy, here are some beneficial ideas to think about: Think about term life insurance policy. These policies supply protection throughout years with considerable economic responsibilities, like home mortgages, student fundings, or when looking after young youngsters. Make sure to look around for the very best rate.

Self-financing With Life Insurance

Envision never ever having to fret about financial institution fundings or high rate of interest prices once again. That's the power of boundless financial life insurance coverage.

There's no set funding term, and you have the freedom to choose the payment routine, which can be as leisurely as repaying the finance at the time of death. This flexibility reaches the servicing of the loans, where you can go with interest-only payments, keeping the financing equilibrium flat and convenient.

What are the most successful uses of Policy Loans?

Holding money in an IUL dealt with account being credited interest can usually be better than holding the money on deposit at a bank.: You've constantly dreamed of opening your very own pastry shop. You can borrow from your IUL plan to cover the preliminary expenditures of leasing a room, acquiring equipment, and hiring personnel.

Personal lendings can be acquired from typical banks and cooperative credit union. Below are some crucial factors to think about. Charge card can give an adaptable method to obtain cash for extremely temporary periods. Nevertheless, obtaining money on a charge card is usually extremely expensive with interest rate of passion (APR) typically reaching 20% to 30% or even more a year.

Latest Posts

Cash Flow Whole Life Insurance

How To Set Up Infinite Banking

Infinite Banking Concept Canada